What we did

Media Relations

Content

Surveys

Industry

Background

RELEX delivers a unified platform for retail, manufacturing, and supply chain planning, enabled by proven AI technology. The company helps retailers, manufacturers, and consumer goods companies optimize demand forecasting, replenishment, merchandising, pricing and promotions, supply chain operations, and production planning.

Challenge

RELEX wanted to punch above its weight in a competitive field dominated by larger, more established names. The brand needed to break into tier-one media, shift from basic coverage to more in-depth storytelling, and gain greater Share of Voice and domain authority against industry giants. A key priority was also elevating new subject matter experts — leaders with strong retail expertise but limited name recognition. The challenge: earn credibility, build visibility, and make RELEX an indispensable voice in the retail tech conversation.

Solution

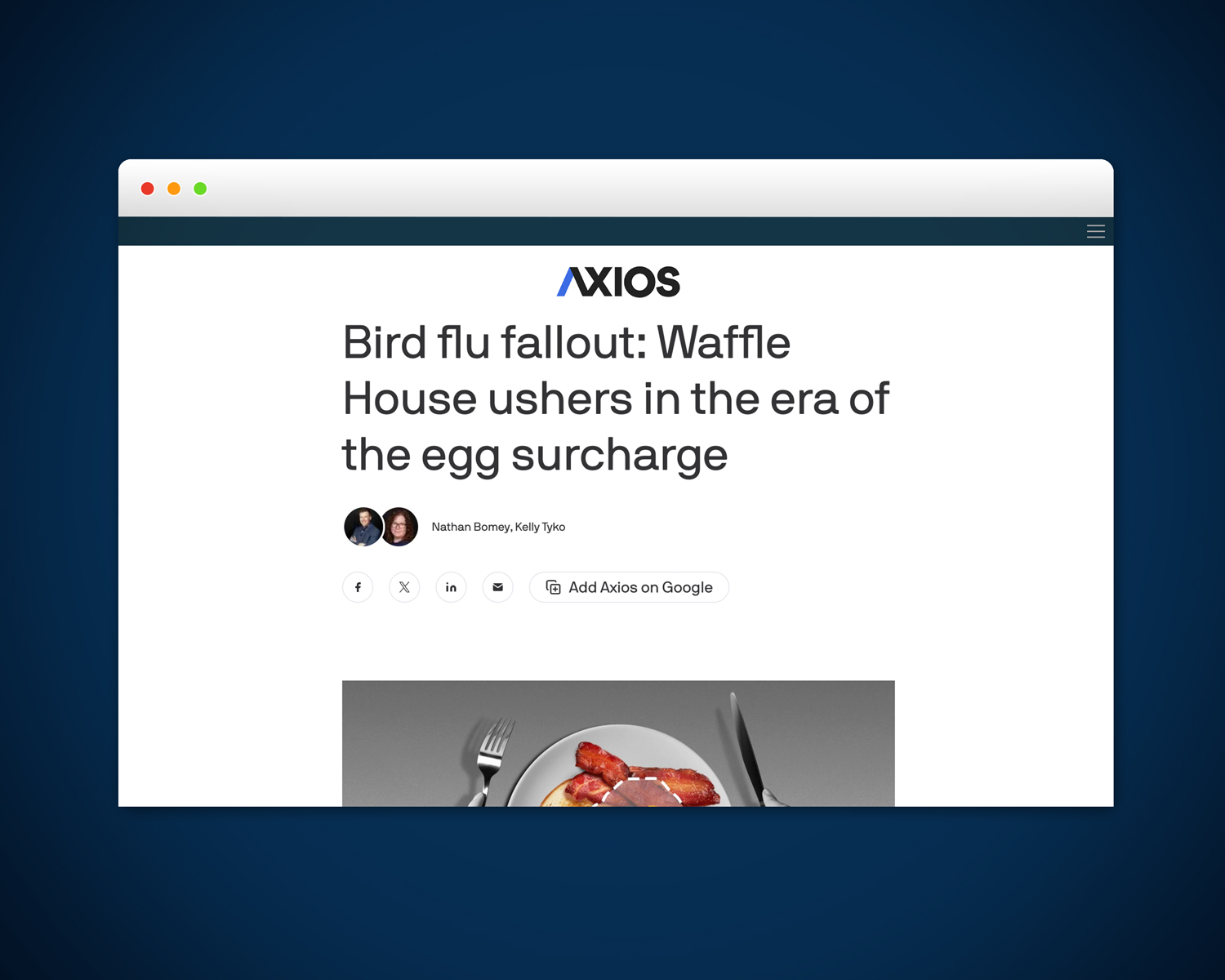

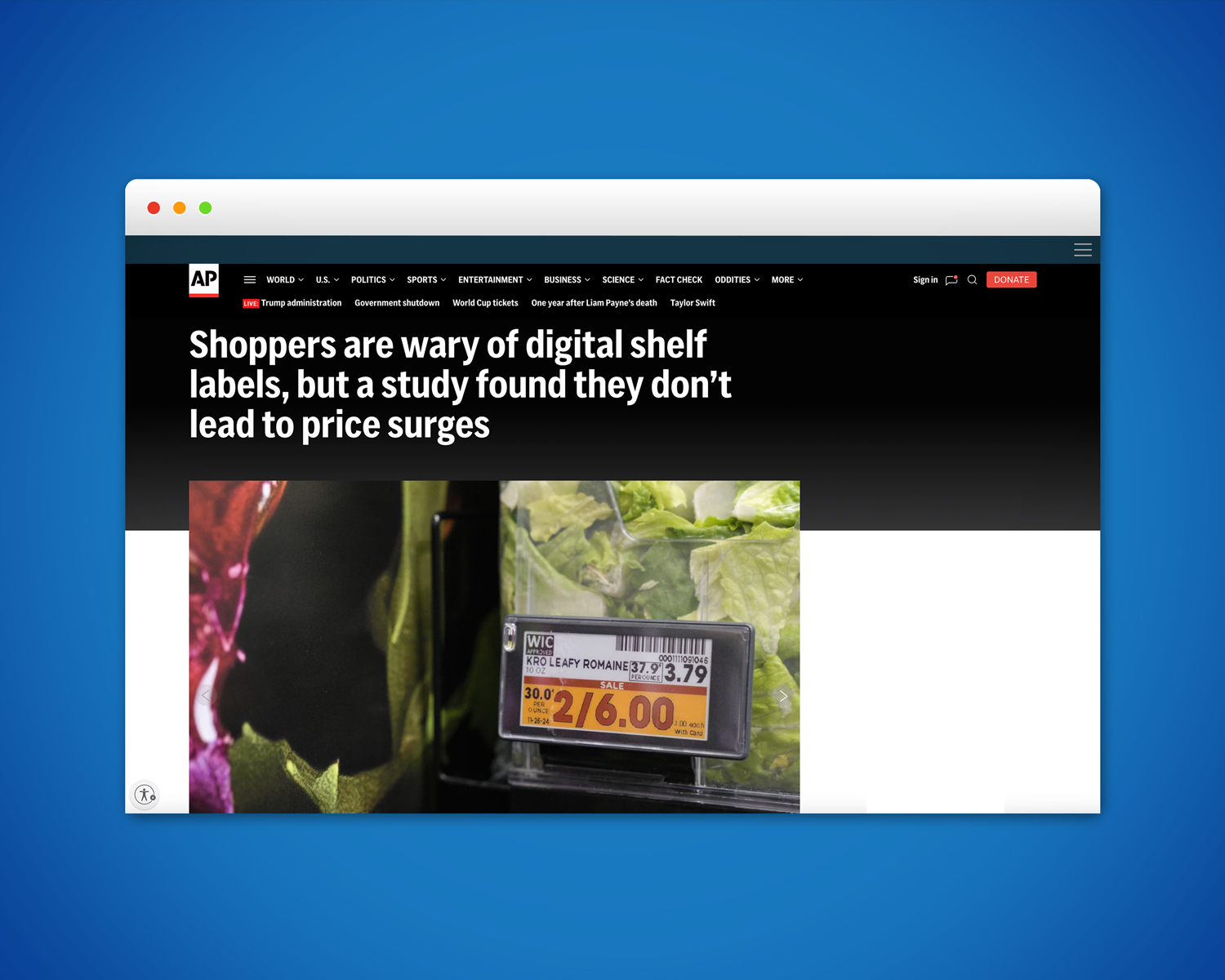

Gregory launched a multi-pronged media strategy rooted in news relevance and executive authority. We tapped into the fast-moving retail news cycle with rapid-response commentary and timely newsjacking opportunities — from tariffs to economic shifts and isolated supply chain events affecting inventory and pricing. At the same time, we built a steady drumbeat of thought leadership and data-driven storytelling, crafting both consumer-facing angles and enterprise-level narratives that reflected RELEX’s insights and POV.

This mix of timely, smart pitching and consistent value-add helped RELEX cut through the noise, spark media interest, and build the reputations of its emerging SMEs. By meeting the moment with insight — and backing it with substance — we reshaped how the market and media saw the brand.

By the Numbers

FAQ

By translating outcomes (higher on-shelf availability, lower waste/markdowns, better forecast accuracy) into proof points cited by retail and business press that buyers discover during vendor research.

A differentiated point of view on demand forecasting, replenishment, and pricing; rapid expert commentary on retail news; and recurring, data-backed content (e.g., price/promo or OSA indices) that media and buyers reference.

Inflation and price elasticity, promo effectiveness, shrink/availability, ESL adoption, labor/productivity, tariffs and supply risk, GLP-1 impacts on baskets, and sustainability tied to waste reduction.

Explain the model inputs, guardrails, and human-in-the-loop workflows; focus on business KPIs (forecast error, inventory turns, spoilage) and use third-party validations instead of performance claims.

Short data notes, monthly/quarterly indices, buyer-persona explainers (Merch, Supply Chain, Finance, IT), and anonymized case snapshots tied to SKU-level outcomes.

Run statistically valid consumer or merchant panels on elasticity, promo fatigue, or OSA pain points; publish methodology and cross-tabs so reporters and buyers can cite with confidence.

Plan quick-turn commentary and data drops for key windows: NRF/Shoptalk/Groceryshop, back-to-school, holiday, tariff milestones, weather events, and produce seasons for fresh/CPG.

Pair each SME with a beat (pricing, replenishment, store ops), create rapid-response briefs with quotable takes, and stack smaller trade wins into pitches for tier-one business outlets.

Measured changes in stockouts, waste/markdown %, forecast accuracy, working capital, fulfillment SLAs, and promo lift—corroborated by customer or third-party quotes and press coverage.

Make independently verified outcomes easy to find (media links, awards, analyst mentions), map thought leadership to RFP criteria, and seed buyer FAQs that answer IT/security questions up front.

Lead with governance: data segregation, permissions, auditability, bias testing, and retailer ownership of insights; keep language factual and compliance-reviewed.

Yes—authoritative backlinks from tier-one and trade coverage to deep product/solution pages increase rankings and branded search, compounding pipeline over time.

Secure panels and media meetings at NRF, Shoptalk, Groceryshop, CES (retail tech), and supply chain conferences; time data stories or surveys to those shows for maximum pickup.

Publish sector-specific cuts (fresh shrink vs. apparel markdowns, promo lift by category), then pitch vertical trades and regional business media with tailored takeaways.

Reframe to augmentation (better demand signals, fewer manual overrides), shopper value (availability, fairer pricing), and employee experience (fewer fire drills, smarter tasks).

Share of voice vs. key competitors, tier-one/trade citations, high-authority backlinks, inbound demo/RFP requests, and correlations between coverage bursts and opportunity creation.