What we did

Public Relations

Content Marketing

Creative Services

Industry

Background

Allianz Investment Management (AllianzIM) serves as the U.S. asset management arm of Allianz Life, a leading American life insurance company and a subsidiary of the global financial powerhouse Allianz Group. Managing over $17 billion in assets, AllianzIM specializes in crafting innovative risk management solutions, including annuities and life insurance products, that are designed to support long-term financial security. In December 2019, AllianzIM engaged Gregory to support the launch of its suite of Buffered ETFs, marking a strategic expansion of the firm’s broader risk management offerings.

Challenge

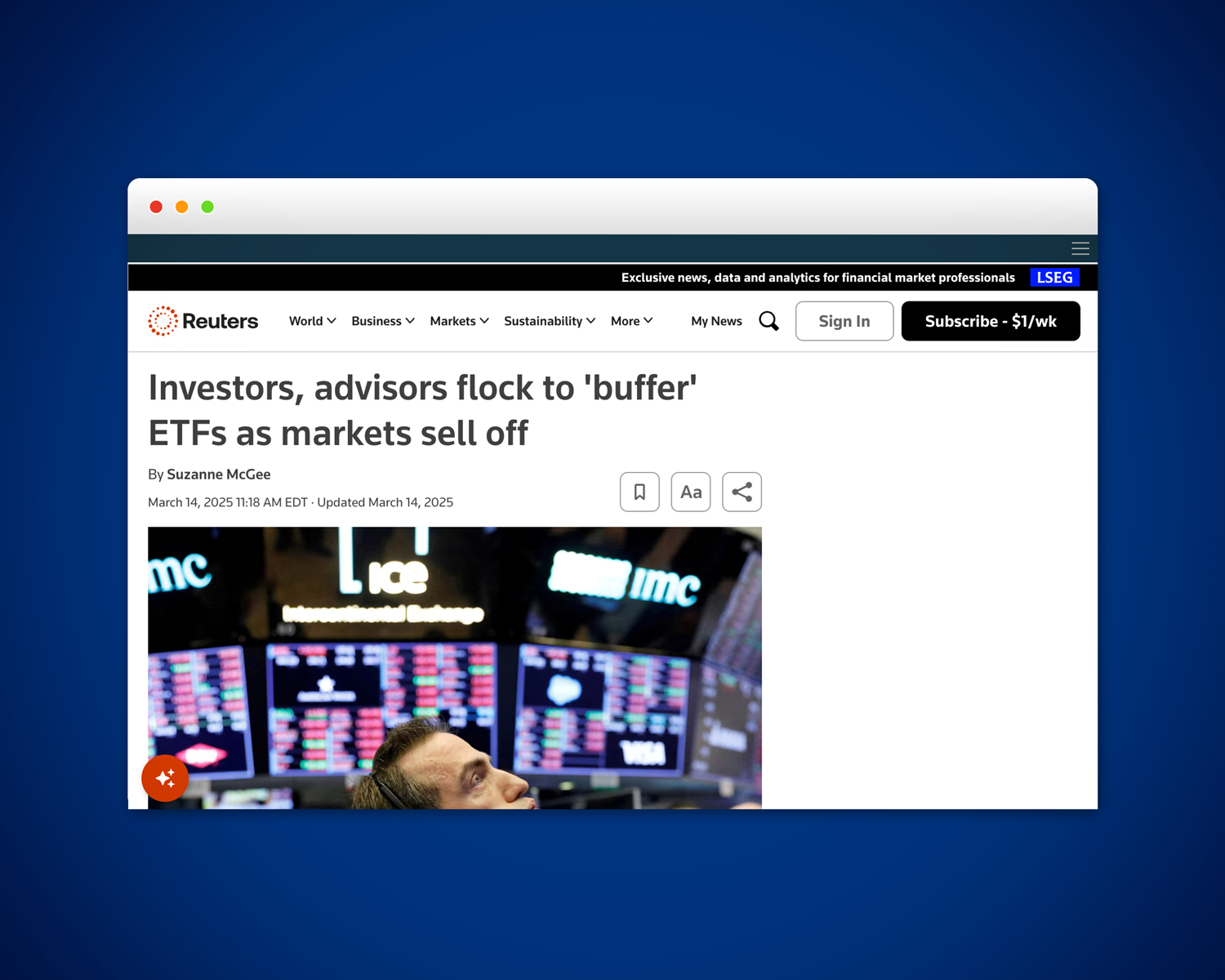

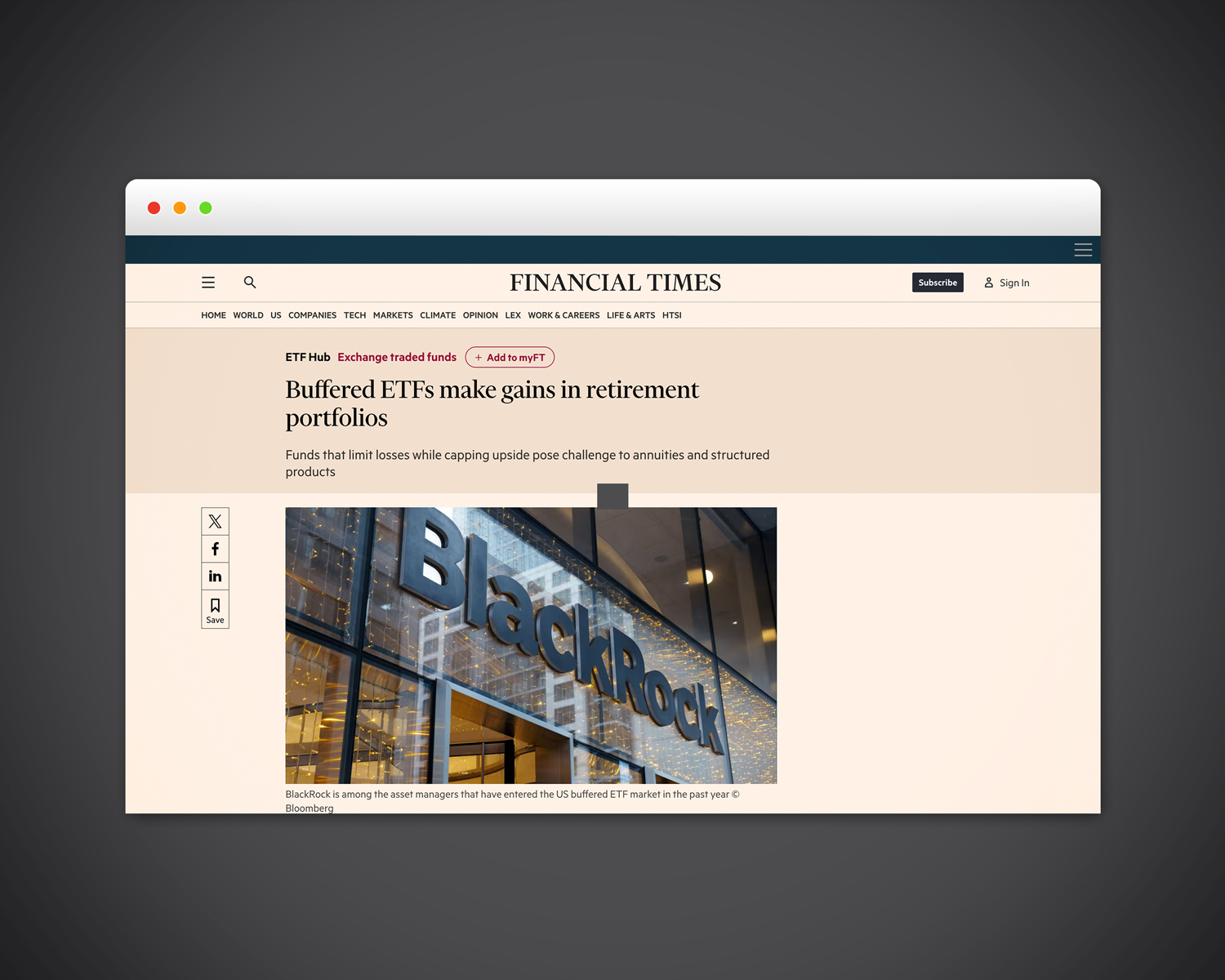

AllianzIM launched its ETF suite as competition in the emerging defined/buffered outcome category was heating up, with several players already establishing a foothold. In addition to carving out differentiation in a growing segment, AllianzIM also faced the unique task of positioning its long-standing reputation as a trusted name in insurance within a market that prized financial innovation and agility. Striking the right balance between legacy credibility and forward-looking product development was key.

Solution

Gregory FCA provided strategic counsel on how to effectively position AllianzIM’s century-long legacy of risk management within a modern, solutions-oriented framework tailored to the evolving priorities of financial advisors and investors. This included the development of foundational marketing assets — such as the website, fact sheets, and pitch book — ahead of the ETF suite’s launch in June 2020. Gregory also designed and executed a targeted media strategy to establish AllianzIM’s presence and credibility in the competitive ETF landscape.

To further distinguish AllianzIM in the market, Gregory FCA continues to implement a multi-pronged media campaign aimed at elevating both the brand and its products, while simultaneously raising the visibility of key ETF team leaders, including Johan Grahn and Charles Champagne.

By the Numbers

FAQ

Start with a crisp positioning (what problem the ETF solves, for whom, and how it differs), then pair it with embargoed media briefings, advisor-centric explainers, and day-0 collateral (site, fact sheet, pitch book) that make due-diligence easy.

Translate long-standing risk-management expertise into ETF language (index/methodology, buffers/defined outcomes, tracking, liquidity) and let third parties carry proof—tier-1 coverage, analyst notes, and disciplined spokesperson interviews.

A fast, compliant product site; one-page fact sheet + methodology brief; advisor talk tracks and FAQs; presentation deck; and a media kit (bios, quote bank, charts). Keep all aligned to a message map approved by legal/CCO.

Sustain a cadence: market-context commentary, bylines tied to portfolio use cases, broadcast/radio slots around volatility, and timely education (webinars, CE-eligible sessions) that answers allocation questions without performance promises.

Share of voice vs. peer set, tier-1/trade citations and backlinks to product pages, growth in branded/ticker search, advisor engagement (webinars, downloads), platform listings, and correlations between coverage bursts and primary-market activity.